Page 71 -

P. 71

Notes to the Consolidated Financial Statements

31st March 2016

15 INVESTMENT PROPERTIES

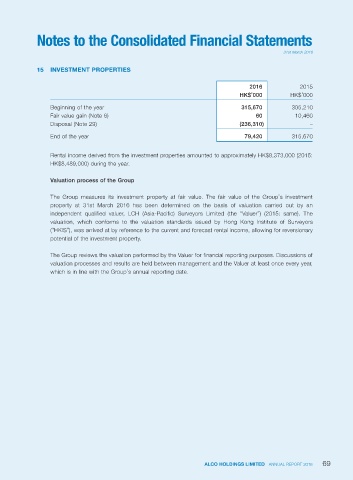

2016 2015

HK$’000 HK$’000

Beginning of the year 315,670 305,210

Fair value gain (Note 6) 60 10,460

Disposal (Note 29) (236,310) –

End of the year 79,420 315,670

Rental income derived from the investment properties amounted to approximately HK$8,373,000 (2015:

HK$8,489,000) during the year.

Valuation process of the Group

The Group measures its investment property at fair value. The fair value of the Group’s investment

property at 31st March 2016 has been determined on the basis of valuation carried out by an

independent qualified valuer, LCH (Asia-Pacific) Surveyors Limited (the “Valuer”) (2015: same). The

valuation, which conforms to the valuation standards issued by Hong Kong Institute of Surveyors

(“HKIS”), was arrived at by reference to the current and forecast rental income, allowing for reversionary

potential of the investment property.

The Group reviews the valuation performed by the Valuer for financial reporting purposes. Discussions of

valuation processes and results are held between management and the Valuer at least once every year,

which is in line with the Group’s annual reporting date.

ALCO HOLDINGS LIMITED ANNUAL REPORT 2016 69