Page 82 -

P. 82

Notes to the Consolidated Financial Statements

31st March 2016

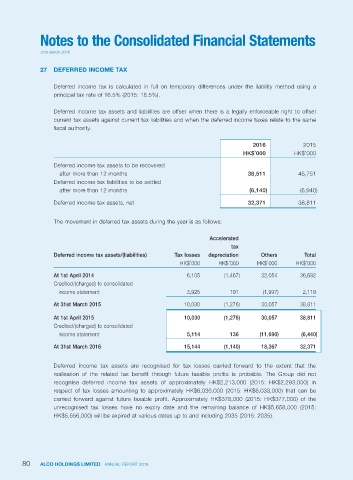

27 DEFERRED INCOME TAX

Deferred income tax is calculated in full on temporary differences under the liability method using a

principal tax rate of 16.5% (2015: 16.5%).

Deferred income tax assets and liabilities are offset when there is a legally enforceable right to offset

current tax assets against current tax liabilities and when the deferred income taxes relate to the same

fiscal authority.

2016 2015

HK$’000 HK$’000

Deferred income tax assets to be recovered

after more than 12 months 38,511 45,751

Deferred income tax liabilities to be settled

after more than 12 months (6,140) (6,940)

Deferred income tax assets, net 32,371 38,811

The movement in deferred tax assets during the year is as follows:

Accelerated

tax

Deferred income tax assets/(liabilities) Tax losses depreciation Others Total

HK$’000 HK$’000 HK$’000 HK$’000

At 1st April 2014 6,105 (1,467) 32,054 36,692

Credited/(charged) to consolidated

income statement 3,925 191 (1,997) 2,119

At 31st March 2015 10,030 (1,276) 30,057 38,811

At 1st April 2015 10,030 (1,276) 30,057 38,811

Credited/(charged) to consolidated

income statement 5,114 136 (11,690) (6,440)

At 31st March 2016 15,144 (1,140) 18,367 32,371

Deferred income tax assets are recognised for tax losses carried forward to the extent that the

realisation of the related tax benefit through future taxable profits is probable. The Group did not

recognise deferred income tax assets of approximately HK$2,213,000 (2015: HK$2,293,000) in

respect of tax losses amounting to approximately HK$6,036,000 (2015: HK$6,033,000) that can be

carried forward against future taxable profit. Approximately HK$378,000 (2015: HK$377,000) of the

unrecognised tax losses have no expiry date and the remaining balance of HK$5,658,000 (2015:

HK$5,656,000) will be expired at various dates up to and including 2035 (2015: 2035).

80 ALCO HOLDINGS LIMITED ANNUAL REPORT 2016